What does financial freedom mean for your business?

It’s an exciting time. Your Employee Owned business is successfully paying off the exiting owners, and you are eyeing up ‘financial freedom’.

This means you’ll have more money to invest in the business, at a time when you’ll be navigating a whole new financial structure and the responsiblities that come with being fully employee owned. It’s time to ask yourself:

- Have you considered how to both reward existing staff, and incorporate new ones?

- Do you have a plan that enables you to invest in both the company and your employees?

- Are you primed to take advantage of any surplus cash once you’ve achieved Financial Freedom?

If you don’t know the answer to any of these questions, don’t worry – we can help. EO members can book a complimentary consultation with us to find out more about what’s possible. In the meantime, read on to find out more.

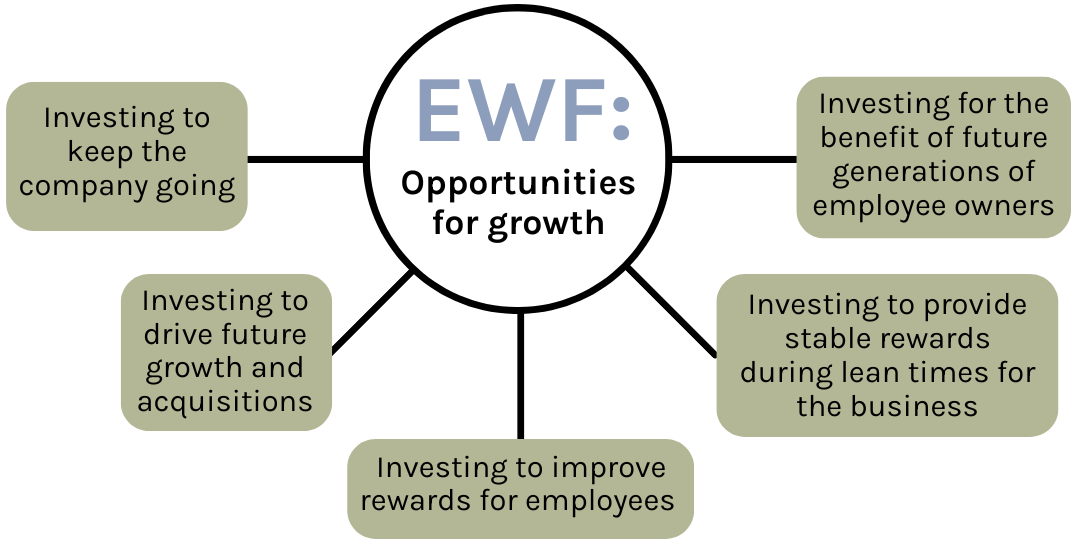

What is the Employee Wealth Fund (EWF)?

The EWF is designed for businesses who are making, or have completed, their staggered payments to their exiting owners. These businesses will find themselves evolving – with a changing staff body, areas that require fresh investment, and perhaps even a completely new strategy. All these changes have financial elements that would benefit from specialist help.

In addition, once payments are completed, there are likely to be investment opportunities – opportunities that many EO businesses aren’t taking advantage of. As specialists in fund investment and risk management, we are perfectly placed to help you grow your surplus cash, which can then be fed back into your ongoing costs – be that staff rewards, expansion, or something else.

What investment options are available to EO businesses?

There are a variety of opportunities that can potentially be leveraged, depending on the nature of your company and what’s most appropriate for you. Examples include:

There are a variety of opportunities that can potentially be leveraged, depending on the nature of your company and what’s most appropriate for you. Examples include:

Corporate investment plans

These plans aim to grow your retained profits over the years and build up a ‘war chest’ to allow the company to negotiate any tough periods or fulfil its growth plans without taking on debt.

Employee-owned wealth funds

This is a bit like a university trust fund, which uses returns to cover the maintenance of buildings, new resources and improved facilities, with the aim of helping keep fees down. In a company setting, investing your profits in this way could lead to bigger payouts for employee owners in the future – or investment growth could be used to cover the costs of the employee benefits packages.

Case study

Let’s look at a simple example that illustrates how modest investment gains can be transformational.

A company makes £1m surplus profit a year, with 15 employee owners.

If it invested that £1m and achieved a 5.5% return per year net of tax, in the first year, the company has made £55,000 – without lifting a finger.

The company could then distribute this money to cover the £3,600 a year tax-free allowance for every employee, without touching the original £1m of profits.

Next year, the company makes another £1m of profit, which goes into the pot, making £2m in total. If it made 5.5% on that £2m, it would make £110,000 in year 2 – half of which could cover the £3,600 a year tax-free allowance, and the other half invested in a flexible benefit provision.

And so on, year after year…With the profit ‘war chest’ remaining untouched.

Please note the above numbers are indicative. All investments carry a degree of risk and you should consult a financial adviser before proceeding.

Does my business need to reinvest profits? Why bother?

The answer to this question lies partly in the various responsibilities and duties that all company directors and trustees are bound by. A company has a duty to its shareholders; namely to:

1. Ensure the business can continue running in the future, and provide the necessary capital and assets to do so.

2. Reinvest profits to provide investment growth for its shareholders OR distribute those profits to its shareholders (in the case of EO companies, this is the Trust).

The Trustees have a duty to manage the Trust’s assets (its shares in the business) for the beneficiaries (the employees), both current and future.

However, this is only one part of the picture. Through reinvestment, you’re not just fulfilling your responsibilities. You’re potentially unlocking a wealth of benefits for staff and business alike…

Your next step: Talk to us about EO

Start planning for the future you want today: EO members are entitled to a complimentary consultation with one of our specialists.

This is a chance for us to find out a little more about your business, and for you to ask any questions you need to. It is complimentary and there is no commitment required on the back of it.

We look forward to speaking to you.