James Whittington is an independent Chartered Financial Planner. Since graduating from Cambridge University, he has built up over 15 years’ experience across the finance industry, covering investment banking; investment modelling and risk management within the Lloyd’s of London market; and personal financial planning.

Short Answer: Yes, you can retire at 55.

When it comes to the idea of early retirement, 55 is the age that most people have in their head. It is the age that you can access most types of pensions (called the Normal Minimum Pension Age), and people therefore assume it is the earliest age you can retire at. In fact, the Normal Minimum Pension Age used to be 50 until 2010 – and some people may still be able to access their pensions from that age.

Ultimately, those that want to retire at 50, 45 or even 40 can still do so if they are set up in the right way. In this article, I’ll share some of the key things you’ll need to consider if you’re thinking about retiring early.

First, some life admin: retirement ages are changing!

Before we get going, you should know that the Normal Minimum Pension Age is increasing from 55 to 57, from 6th April 2028. There is some transitional protection for people that are coming up to age 55. In addition, the State Pension Age is increasing to age 67 between 2026-2028. From this point on, the Normal Minimum Pension Age will be linked to the State Pension Age and will trail it by 10 years. It is expected that the State Pension Age will increase to 68 by 2046 at the latest, which means the Normal Minimum Pension Age will increase to 58 years old. Independent research has suggested that for the State Pension to remain affordable to the government, the State Pension Age will need to increase to age 71 in the coming years, so watch this space…

If these increasing pension ages might impact your retirement plans, you should speak to a financial planner as soon as possible to ensure you are still on track.

Why is all this important? Because if you want to retire before the normal minimum or the state pension ages, then you will need to ensure you have other means to support you.

Let’s delve into some of the factors that determine whether you can afford to retire.

How much do I need for a good retirement?

This really depends on what is classed as a ‘good’ lifestyle for you. It usually follows that this is linked to the kind of lifestyle you have become accustomed to in the lead-up to retirement. It sounds like an obvious statement but the amount we ‘need’ in retirement can vary wildly from person to person.

Whatever that amount is for you, it’s important to remember that you must end up with this amount (your ‘Number’) after paying any tax – which can have a big impact on which pots we need to take money from, and in what order.

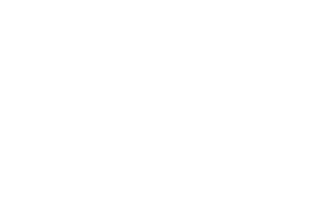

As a starting point, Which? Regularly surveys its retired members to find out how much they need in retirement for different lifestyle types.

Image: ‘Which’ Magazine

‘Essential’ spending covers everything needed just to get by (such as food, transport, utility bills, clothes, etc). The ‘Comfortable’ income target includes leisure activities, short haul holidays and gifts. The ‘Luxury’ target also includes home improvements, health club memberships, long haul holidays and a new car every five years. (Please do note that the figures given in both of these examples will have increased significantly over the last couple of years due to inflation.)

Ultimately, your ‘Number’ will depend on what you want to do in retirement and the type of lifestyle you wish to have.

How do I calculate my ‘Number’?

When working out what this is, you need to be very diligent in calculating not only your essential spend, but what you will actually want to spend on the ‘nice-to-haves’: the fun things in life, like going out, entertainment and holidays. Our experience tells us that around 90% of people underestimate this, so be careful – it can lead to you not enjoying the retirement you had hoped for.

We always tell our clients to dream big – you only get to enjoy one retirement!

You will also need to think how your spending will change once you stop work. You will not have commuting costs to contend with, but you may travel more to see friends and family. You will have likely paid off your mortgage by the time you stop work, but are you spending more on activities and entertainment because you have more free time?

It’s highly likely the kids will have flown the nest by that point too – however, you may be spending money on helping them out (for example, with house deposits or school fees for your grandchildren). You will probably be paying less tax than when you were working too: at the very least, you will not pay national insurance unless you continue earning money through work.

A useful rule of thumb is to assume you will need two-thirds of your gross salary to maintain a similar level of lifestyle in retirement. Of course, rules of thumb should only be seen as a starting point to determine the right level of retirement spending for you personally. There is no substitute for detailed financial planning.

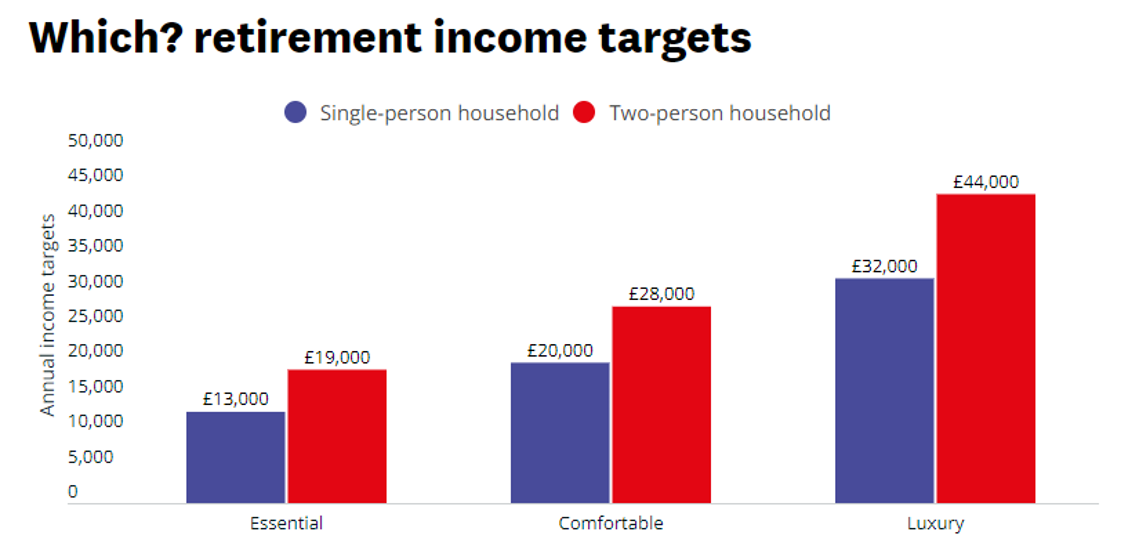

The Retirement Spending Smile

The Retirement Spending Smile principle says that people typically spend more in their early years of financial independence, because they are young and active and want to travel. Spending then typically tails off when they reach their late 70s/early 80s as they take less holidays, stay closer to home and are generally less active.

Spending may then increase again in their later years if they have to pay for care, which can last a few years.

The ‘Retirement Spending Smile’

If there are big one-off spending plans in the first few years of retirement (a new car, a motorhome, a cruise to Antarctica…) we would also take these into account when creating a client’s financial plan.

Inflation-proof planning

The amount we need in retirement will also go up with inflation. An estimation of £50,000 per year for retirement in in today’s money might, in 20 years’ time, actually translate into £100,000 per year. This is why we always need to inflation-proof our income and pots of money as much as possible. You can find out more about how this can be managed in the ‘retirement income’ section below.

How long are you going to live?

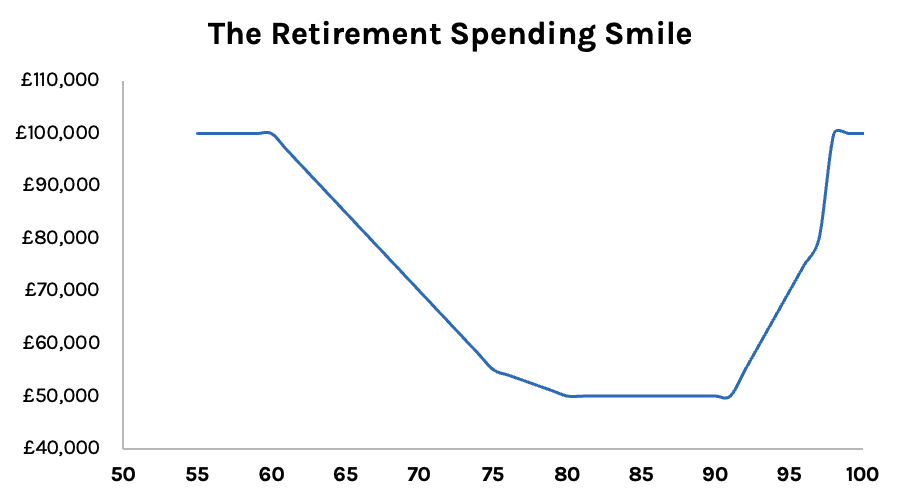

If you are planning to retire at 55, the chances are you will live another 30 years or more. The average life expectancy for a 55-year-old living in the UK is 84 for a man and 87 for a woman, according to the Office for National Statistics (ONS). Great – so if you stop working at age 55, you need enough money to last you roughly 30 years, right?

Not exactly.

These figures don’t take into account differences in region, socio-economic standing, personal health and so on. Plus, an average life expectancy is exactly that: an average. Millions of people will die earlier and millions will die later; the average of all these is the number that sits in the middle. This might sound like morbid thinking, but it’s really the opposite: we must think positively when planning for retirement! If your plans assume you live to 85, but you actually live until age 100, you may have no money for the last 15 years of your life.

ONS statistics for a woman currently 55 years of age

There’s typically no hard and fast answer here, as we don’t know how long we will be around for. The important thing is to plan as if you are going to be around for a long time, so that you don’t run out of money in your later life.

I know how much I need – what’s next?

Once you know how much money you think you will need per year, the next steps are to understand how you will meet your needs.

What retirement income will I get, and will it be enough to retire at 55?

The money you can draw from in retirement can come from a variety of sources. The most common ones are:

- The State Pension

- Other pensions you may hold

- Consultancy work (through your own area of expertise)

- Rental income on any properties you own

- Dividends on any shares you may own

In order to calculate these, we highly recommend that you refer to our guide to retirement:

Read our comprehensive guide to retirement >

Once you have taken away the income you expect to receive from what you think you will need, and projected this over how long you think you will live, you start to see if you have a shortfall. This is when you will have to draw on other funds. In this scenario, you will need to look to cash, ISAs, private pension pots and other investments.

If you use your money wisely and invest it, then you could benefit from investment growth to make up any shortfall between your retirement incomes and your planned expenditure*. Remember that investment growth does not stop at retirement, and that you need only draw what you need each year, leaving the rest invested to continue growing over the rest of your life.

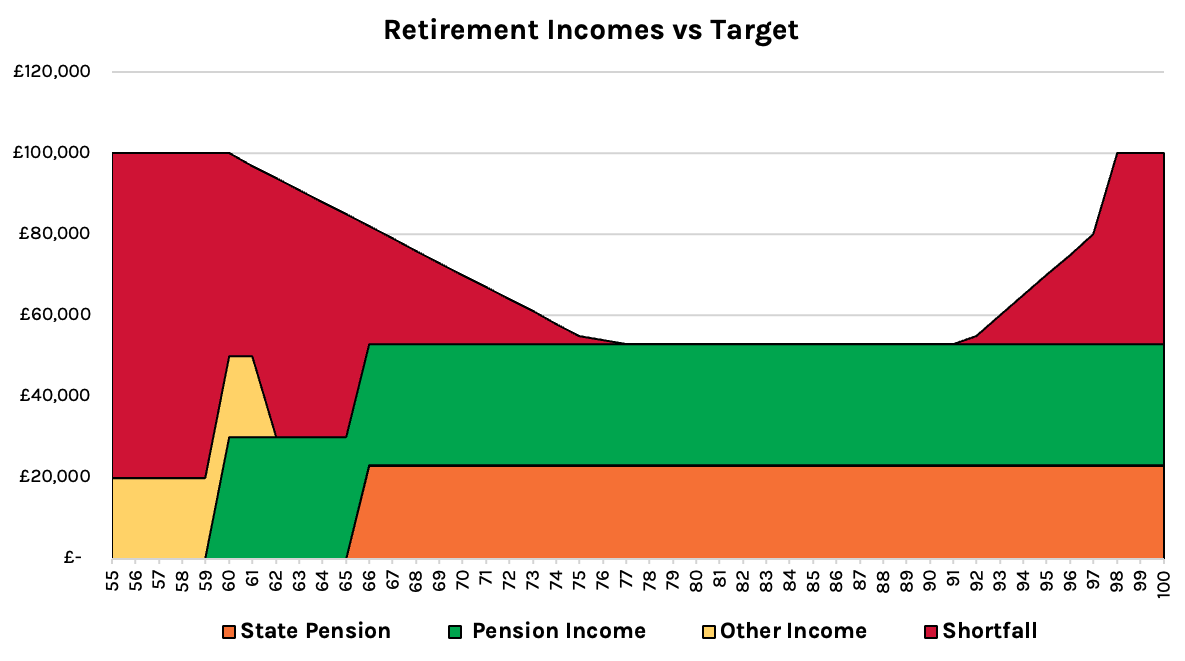

To illustrate this, here’s an example of how additional investment could meet the needs of someone hoping to retire at age 55.

The black line at the top – i.e., the line dividing the white space from the coloured space – represents the target retirement income. You may recognise the ‘Retirement Smile’ shape from earlier in this guide:

Image: Sources of funds to meet your retirement target – without investment

You can see the dark blue section is the State Pension, kicking in at age 66. In this example there is also a final salary pension (green) that starts at age 60. By the time both of these are in payment, a large chunk of our retirement income is being met (helped by the fact that there is less spending going on in this period of life).

We have also got some additional income (yellow) in the early years of retirement, due to consultancy work. But as it stands, this income is not enough to make up the shortfall (red).

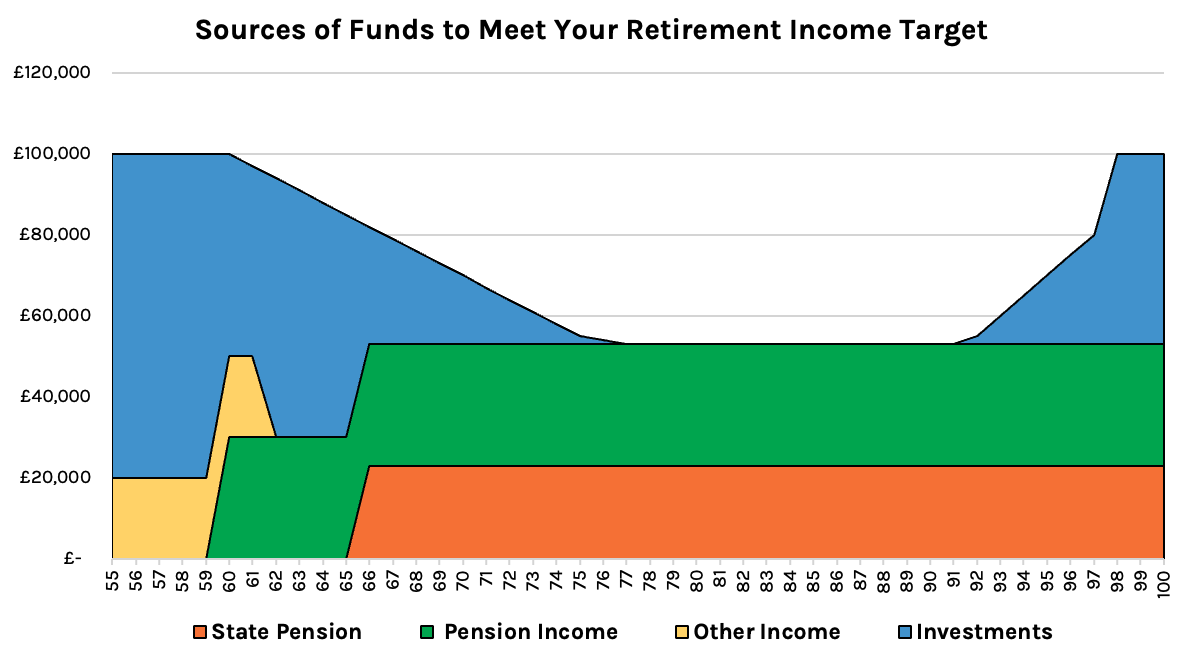

However if we use our retirement pots to fill our spending gap, then we should have enough to get rid of the red. Let’s say we have an investment pot of £1 million, and we achieved 4% growth a year on those investments. The spending picture would now look like this:

Image: Sources of funds to meet your retirement target – with investment

We can see that we are drawing on just enough of our investments (blue) to meet the gap.

Investing your money also gives it the best chance to at least maintain its value against inflation over the long-term and to grow enough to meet any shortfall in later life. Cash doesn’t usually keep up with inflation – just look at how the cost of goods are rising today, in comparison to the interest rates on your savings. If you leave all your money in cash, then it will lose value over time, and you are more likely to run out of money in your retirement.

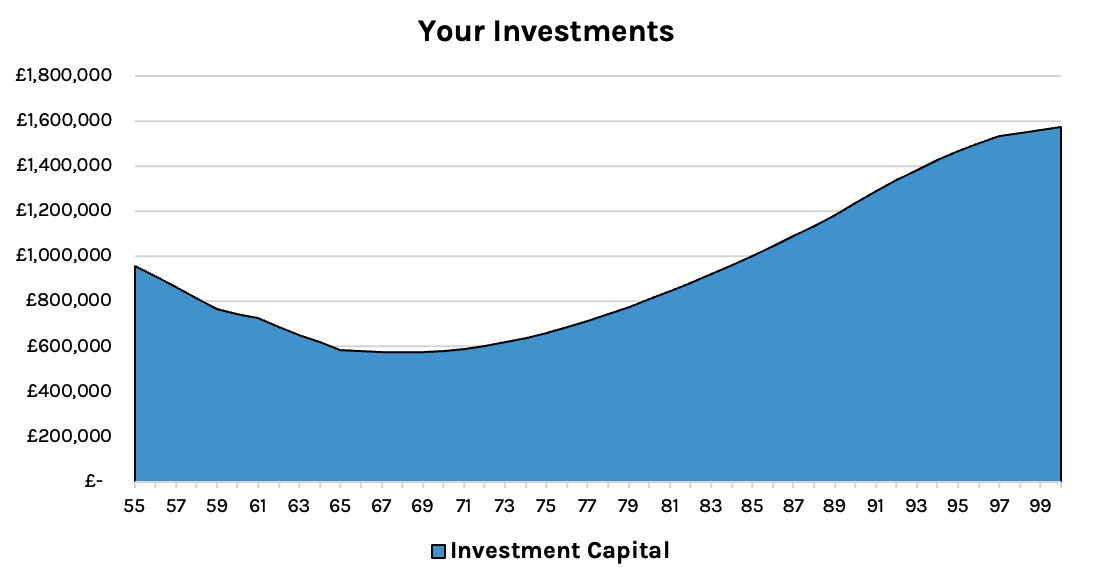

You might well ask: how can we have confidence that our investment portfolio last the course? Will there be anything left over to pass on to the kids and grandkids?

Remember that whilst you will probably be drawing on more money in the early years of your retirement, that spending will decrease as you get older. At that point, your investment pot is likely to start to grow again. The idea is that you will then have enough money in your later life for things like care homes, and ultimately to pass on as inheritance gifts.

Image: How your investment pot might grow

The way I like to picture planning for retirement is that whilst we are working, we have a big bucket with a tap on it. The tap is turned on and water (money) is flowing out of that bucket in different directions. A lot of the money is being used there and then to keep a roof over our heads, food on the table and generally to live life.

Some of the money, however will be flowing into different buckets that will be used at different points during our lifetime (before or during retirement). Ideally we will have a number of different buckets, with different tax statuses and different investments in them, and different timeframes in mind (like ISAs and pensions).

When we come to retire, we will be turning down the tap on the big income bucket from work, and turning on taps on the other buckets that we have been filling up, as well as additional buckets from any defined benefit pensions and the State Pension.

So how can I retire at 55?

So how can I retire at 55?

Short Answer: Build a plan and start filling up those buckets!

There is an old Chinese proverb that says “The best time to plant a tree was 20 years ago. The second best time is today”. This completely sums up planning for your financial future. It takes time to develop a plan and grow towards achieving your goals, and the sooner you start, the better. But even if you have left it late, it’s still far better to act today than to do nothing and wait until tomorrow.

The key steps to enable you to retire at 55 are:

- Plan how much you are going to need and how long you are going to live

- Work out your retirement incomes and therefore what your shortfall is

- Estimate “Your Number” to meet this shortfall

- Prioritise and balance living in the now vs your future financial security

- Save and invest your surplus income whilst still working, maximising your tax allowances where you can (e.g. pension annual allowance, ISA allowance etc.)

- Determine the best way to use your investments to meet any shortfall in retirement

While it’s possible for anyone to get a rough idea of what their retirement might look like, the complex issues involved really do mean it’s best to speak to a financial planner.

Here are some of the ways in which we would help you with the process:

- Working together to uncover and formalise your goals (our ethos is to help people ‘get more life out of life’ (our motto) and so goal-setting is always the first step

- Building a Financial Life Plan to determine when you can retire and what your retirement will look like, taking into account your current and future incomes and investment pots

- Determining a spending plan so you can still live life now, balanced against the future that you want

- Developing a tax-efficient contribution plan to build a multi-pot portfolio and ensure you are investing enough money in the right type of pots, saving the most tax possible (more tax saved = a better retirement)

- Implementing an evidence-based, globally-diversified investment strategy, aligned to your comfort levels with investing, to ensure your hard-earned money is working hard for you and your future

- Helping you maximise the sale value of your business and any subsequent work and income terms

- Determining when and how best to access your various retirement and pension incomes and whether to turn your investment pots into annuities

- Building a dynamic and tax-efficient withdrawal strategy to ensure your investment pots last as long as possible and continue to grow in the meantime

- Determining whether there is a need to release equity from your property in later life

- Building a succession plan for the next generations and ensuring your wealth stays in the family

- Staying by your side and continuously updating your plan, so you can still meet your goals, no matter what life throws at you. We know the journey is never as easy as from A to B, it is often via C, D and E.

- And of course, potentially increasing your life expectancy!

If you’d like to speak to a financial planner and start your retirement planning today, schedule a no cost, no commitment consultation with one of our experts.

*Remember that investment growth is not guaranteed and you will need to seek specialist advice based on your own financial position.